Amid the crumbling crypto market, the chickens have come home to roost for the once high-flying Bored Ape Yacht Club NFT collection. Sotheby’s auction house and A-list celebrities now face a lawsuit over allegedly inflating BAYC values to profit from retail investors.

The bubble around the Bored Apes seems to have decisively burst. But how did the hype reach such astronomical levels before the inevitable crash?

BAYC’s Meteoric Rise is fueled by Celebrity Hype and Mainstream Adoption

Launched in April 2021, the Bored Ape Yacht Club took the NFT world by storm, rising to a $2.3 billion market cap by that year’s end. Driving this meteoric growth was a mix of celebrity endorsements, social media hype, and the perception of mainstream endorsement.

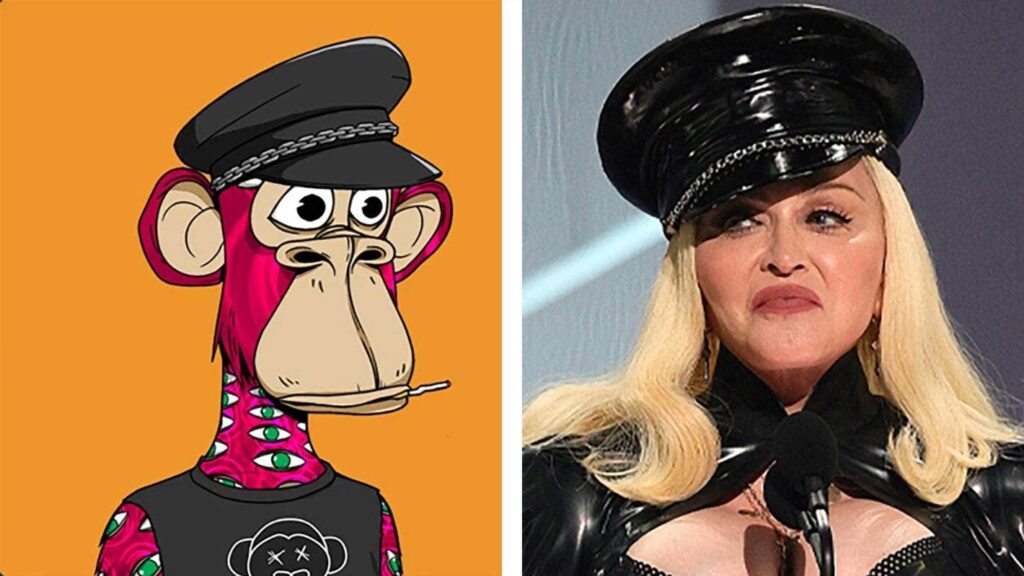

Paris Hilton, Jimmy Fallon, Steph Curry, and Post Malone were just some of the celebrities who snapped up Bored Apes, promoting the NFTs to their millions of followers. Meanwhile, marquee brands like Adidas inked partnerships with BAYC, bolstering its legitimacy in the public eye.

The hype reached fever pitch when Sotheby’s auctioned 101 Apes for $24 million in September 2021 – exceeding the estimate by millions. The plaintiffs argue this gave the impression elite art collectors were investing in BAYC too, further inflating prices.

Alleged Market Manipulation and the FTX Connection

However, the Sotheby’s auction is now subject to intense scrutiny. As per the lawsuit, crypto exchange FTX was the actual buyer – not an outside art collector as initially claimed. If true, this paints the sale as deliberate market manipulation by Sam Bankman-Fried’s outfit.

FTX’s collapse has exposed how SBF and his inner circle inflated assets they owned to extract liquidity from retail investors – before the music stopped. For the plaintiffs, the Sotheby’s BAYC auction seems to be another instance of this unethical pattern.

The lawsuit further alleges that BYAC insiders coordinated with celebrities to hype the collection. Big names received valuable NFTs just for promotions that would lift the floor price. Again, average investors who bought into the hype ended up suffering immense losses.

Fallout for the Wider NFT Market

The plaintiffs argue that the alleged coordinated manipulation around BAYC set a dangerous precedent. Other NFT projects emulated these tactics, relying on celebrity hype and inflated sales to enrich founders at the expense of everyday investors.

When the crypto market turned, these projects saw their valuations decimated, leaving retail buyers holding the bag. For critics, the BAYC saga encapsulates the “greater fool” nature of the NFT craze – buyers hoping someone else pays a higher price.

BAYC Still Faces an Uncertain Future

Despite denials from Sotheby’s and Yuga Labs, the damage to BAYC’s reputation is done. Even as NFT interest revives, most see the collection as tainted by associations with the FTX collapse.

Once the crown jewel commanding hundred-thousand-dollar price tags, Bored Apes now trade below their last peak. Other Yuga Labs NFTs like the Mutant Apes and BAKC land plots have also plunged in value.

For now, the deflated BAYC hype serves as a cautionary tale on the fickleness of NFT valuations. And the Sotheby’s lawsuit may force deeper reflection on ethical promotion standards for digital art.

Key Takeaways: Honesty and Realism, Not Hype, Will Rebuild NFT Trust

The BAYC saga offers some salient lessons for the future of NFTs:

-Celebrity endorsements must be ethical, not pumps for founders to profit

-Mainstream adoption should arise organically, not via engineered hype

-Projects must focus on real use-cases beyond speculation to retain value

-Legal repercussions act as deterrents against clearly manipulative tactics

As NFTs evolve, building real utility into projects is critical. And the community must call out hype and wrongdoing. Measured optimism, not manufactured hype, will put NFTs on a healthier path.

Want more? Connect with NFT News

Follow us on Twitter

Like us on Facebook

Follow us on Instagram

*All investment/financial opinions expressed by NFT News are from the personal research and experience of our site moderators and are intended as educational material only. Individuals are required to fully research any product prior to making any kind of investment.

This information is published by the NFT News media team.