A new report from DappRadar shows figures on how the collapse of Silicon Valley Bank (SVB) has caused a significant drop in the number of active non-fungible token (NFT) traders.

NFT market weathers the storm amidst banking collapse

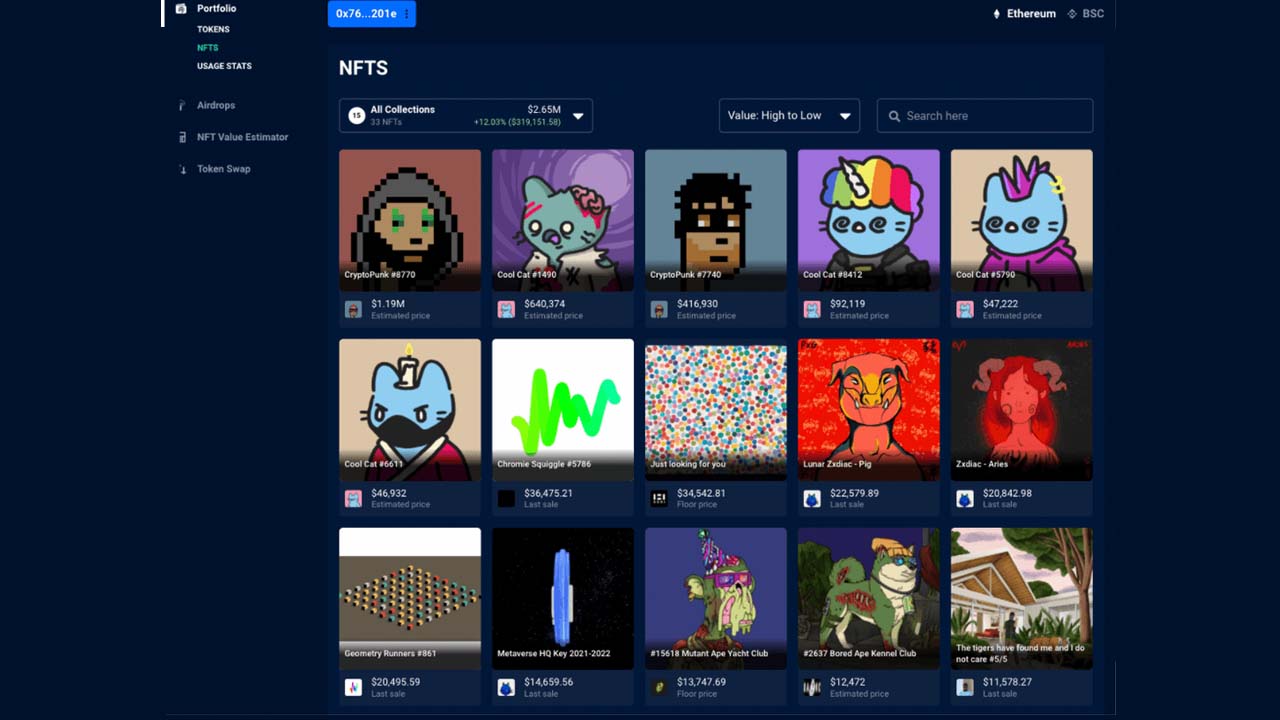

The recent crisis in the American banking system is negatively affecting the NFT market, as previously reported. Now, a recent report from DappRadar indicates that after the Federal Deposit Insurance Corp. (FDIC) took over SVB, the number of active NFT traders plummeted to 12,000, a figure last seen in November 2021.

On the same day, the total amount of single NFT trades reached a mere 33,112, marking the lowest daily count for the entire year. The decrease in trading activity has been remarkable, with NFT trading volume dropping by 51% since the beginning of March and sales experiencing a decline of approximately 16%.

Which NFT collections suffered the most?

Although the impact of recent events was not uniform across all NFT collections, Yuga Labs’ NFT projects, including Bored Ape Yacht Club and CryptoPunks, experienced a minor decline in their base prices on Saturday but swiftly rebounded.

Meanwhile, holders of Proof’s NFT collective Moonbirds faced a significant decrease in its value over the weekend, causing a sense of uncertainty among them. A prominent holder sold 500 Moonbirds on Saturday, resulting in losses ranging from 9% to 33%, amounting to over 700 ETH or roughly $1.1 million.

According to DappRadar’s research analyst Sara Gherghelas, Yuga Labs’ achievements are enhanced by its investment in CryptoPunks and its skill in cultivating a community. Despite the company’s minimal exposure to SVB, its token holders remained largely unaffected by the news, refraining from making any significant decisions.

“They [Yuga Labs] have a very clear road map, the team is visible, and they decided to deliver a good project after the Ape ecosystem. (…) They keep building. They are showing that if you’re part of their community, they have so many perks and benefits.” said Sara Gherghelas

Additionally, Gherghelas remarked that Proof’s association with SVB added to the apprehension surrounding the project. Nonetheless, the company’s recent disappointments compelled some holders to sell their holdings. With the cancellation of its Proof of Conference scheduled for May, the community’s faith in the company’s capacity to fulfill its commitments has been shaken, leaving them in a state of uncertainty.

“People, users, and consumers are becoming pickier and they don’t want hype, they want the perks, the benefits, and the utility behind that NFT collection,” Gherghelas added.

Crypto markets bounce back

Several specialists assert that this decline is a temporary phenomenon, and the market is likely to recuperate eventually. While there is still a long way to go to reach previous highs, the markets have bounced back since the SVB incident, with Bitcoin now trading at 25,000 at the time of writing.

While the SVB downfall has demonstrated the resilience of the cryptocurrencies amidst a banking crisis, it has also highlighted the need for crypto markets to become more decentralized and independent from traditional finance.

Source: nft.news

This news is published and verified by the NFT News media team.